Deputy Editor-in-Chief Grace Holloway unpacks the news of Crystal Palace’s ownership shake-up amidst uncertainty over their European qualification.

On 23 June, Crystal Palace FC confirmed shareholder John Textor had sold his shares to American businessman Woody Johnson for £190million, pending on Premier League and Women’s Super League approval. Textor’s business, Eagle Football Holding, owned 43% of the South London club and 25% of its voting rights.

Crystal Palace ended last season spectacularly with their FA Cup victory, marking the club’s first major trophy. Finally reaching European football was a major achievement for the club, but doubts over their position overshadowed their celebrations.

Crystal Palace’s Doubtful European Qualification

UEFA are now considering Crystal Palace’s place in the Europa League due to their policy on multi-club ownership. According to UEFA guidelines, clubs owned under the same multi-club structure are not allowed to compete in the same competition. Textor’s company, Eagle Football Holding, also owns the French team Olympique Lyon, who also qualified for the competition.

Crystal Palace’s position became at risk, as both teams cannot compete in the Europa League and Lyon would be prioritised as they finished higher in their domestic league. While clubs have found ways around this issue, notably Manchester City and Girona, and RB Salzburg and RB Leipzig, it was expected that UEFA would finally crack down, especially with the recent announcement that Irish team Drogheda United have been expelled from the Conference League due to another club under the same ownership competing in the league.

Clubs often take steps for shareholders to place their shares in a blind trust — a third-party managing a shareholder’s stakes in a club without any input from the original owner — in order to resolve conflicts of interest. UEFA provide a deadline of 1 March for clubs to do this; however, Crystal Palace were unprepared as they sat mid-table in the Premier League before the deadline and had not yet reached the round-of-16 in the FA Cup.The final outcome of UEFA’s decision is expected to be reached before the end of the month.

Textor’s Departure: Hidden Motivations?

John Textor is certainly not one of the most popular football owners. Olympique Lyon are now (25 June) facing relegation to Ligue 2 due to their dire financial situation. Eagle Football Holding, who owns 77% of Lyon, announced debts last year of £422million. The business who also owns shares in Botagago, FC Florida, and RWD Molenbeek, was given a strike off by Companies House earlier this year for failing to publish their accounts and confirmation statements throughout the last financial year.

The American had been looking to sell his shares in the Eagles for a while, having expressed interest in the purchase of Everton FC in September 2024. With UEFA’s crackdown looming for Palace and discussions with DNCG on Lyon’s financial punishment, he rushed into a major sale, which seemed on the surface to be a win-win for both his business and Palace, before the outcome of Lyon’s punishment was announced.

Questions can be raised about whether the sale was to help Eagle Football Holding, especially attempting to reach Lyon out of debt, or whether the move was to help Crystal Palace. The conclusion is unlikely to be met until there is certainty from UEFA on Palace’s position in Europe, which is likely to come before the end of the month.

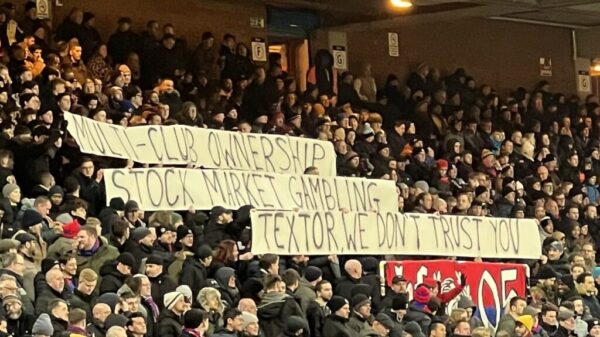

Textor has certainly had a mixed reaction during his time with the club, with the Crystal Palace fan group Holmesdale Fanatics previously displaying a banner that noted ‘Textor, we don’t trust you’, after he considered listing Eagle Football Holding on the US Stock exchange in search of some capital. However, there have been some benefits to his time, with an investment of around £180million into the club since he joined in August 2021.

After the relegation of Lyon was announced, their fans began expressing their discontent towards the owner: “John has never been and never will be the man for the situation. This Botafogo supporter should now leave the Lyon landscape.”

Woody Johnson joins Crystal Palace: What does this mean?

Woody Johnson now holds a 43% share in Crystal Palace, with the club also being owned by Steve Parish, David Blitzer and Josh Harris. The voting rights are shared evenly between all four shareholders, with Chairman Steve Parish running the day-to-day business of the club.

Johnson, who is the heir to the Johnson & Johnson pharmaceutical fortune, also owns the New York Jets, whose fans voiced controversial opinions on his new business venture. The American businessman is also close to the Trump administration, having previously served as US Ambassador to the UK under Trump’s first term.

Just don't let him or his son make any decisions. He's been one of the worst owners in the NFL for decades. The NY Jets have absolutely stunk under his ownership.

— Bodhi 🎱 (@WillyLumpLump22) June 23, 2025

I hope you enjoyed your trophy Palace fans. Cherish those memories. https://t.co/hR9R0dXdDN

— Jeremy Peterman𓅪 (@SportsGuyJeremy) June 23, 2025

Focusing on the short term, Johnson’s addition to the internal business structure could provide new capital to invest in the squad, as he is less debt-ridden than Textor, and crucially help confirm the club’s position in the Europa League. Transfer rumours are already gaining momentum surrounding potential moves to South London, which could become more likely if investment follows suit.

However, there is a risk that Johnson could eye up the other shares offered by Blitzer and Harris, each worth 10%. If purchased, this would make him a majority and controlling shareholder, with the potential to displace the vision and management of Steve Parish, whose popularity has excelled from saving the club from administration to their first trophy. As Johnson’s net worth is estimated to be around $3.4billion he certainly has enough to help the club with long-term player investments, their £200million plan for a new stadium and also to launch a tempting bid for control of the club.

It will be interesting to see what the next steps are for Crystal Palace, with the short-term pending European Qualification, which could change the game for multi-club structures competing in Europe, and the long-term dilemma of how the major internal change will alter the strategy and vision of Crystal Palace.